Financial Planning

Einar Lisborg is a financial planner located in Surrey BC. with over 30 years as a financial adviser. Learn more about what Einar Lisborg can do for your financial future.

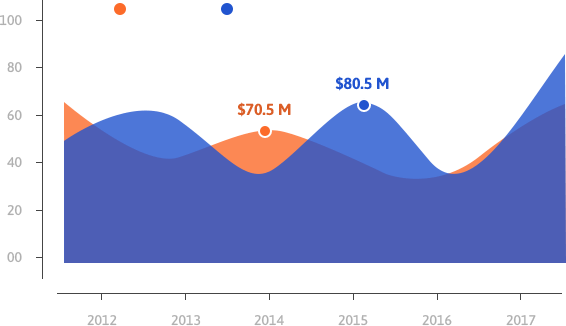

Market Growth

The Market is all about positioning and differentiation which leads you to net gains. Markets go up & down, learn how to make more ups than downs.

On Time Services

The right person for the job. The right accountability with open answers. The right leadership practices, taking you to the next level in investments.

Our Services What We Do

Financial Planning

Financial planning is more than a set of tactics. Financial planning is a process that determines how you can best…

Tax Planning

The biggest mistake many people make is to wait until April to concern themselves with their taxes. Throughout the year…

Strategic Asset Allocation

Strategic asset allocation is an investment theory based on the principles of the Nobel-prize-winning dissertation of Modern Portfolio Theory. When…

30+ Years of experience

Some of the greatest things in life come from learning from others. We have learned how to make your financial well being our priority.

85

Investment Growth %

90

Market Investor %

90

Restirement Planning %

95

Tax Deductible Mortgage

Integrity Thinking of Building

A tangible example of the benefit of strategic asset allocation can be found when reflecting on the technology stock bubble that existed in the late 1990’s and early 2000’s. When technology stocks soared, everyone (including the experts) offered statistics depicting how obvious this phenomenon was and how valuation methods for stocks did not apply to technology stocks. As a result, some clients abandoned strategic asset allocation and started to deviate with a much larger weighting in this sector.

Einar Lisborg has been a Financial Planner for over 20 years. Einar believes in offering the very best in financial services, complete financial planning with NO FEES for service. He believes fee for service financial planning excludes too many people who really need complete financial planning. Compensation by commission with no out of pocket expense to you.

Einar is a Registered Health Underwriter & financial planner. He also obtained the Distinguished Financial Advisor designation specializing in Tax Services. Tax planning is the core of Einar’s practice. He believes that effective tax planning and debt management is the most essential and overlooked areas by most families. Taxes are the largest expense faced by the average Canadian family followed by debt servicing. Getting a handle on debt and taxes is crucial.

Dont Miss Our Latest News

5 blockchain technology use cases in financial services

Sep 05, 20185 blockchain technology use cases in financial services Powering innovation…

MFDA News Canadian securities regulators publish MFDA oversight review report

Sep 05, 2018MFDA News Canadian securities regulators publish MFDA oversight review report…